Here’s The Good, The Bad, and The Real Value of the relaunched Chase Sapphire Reserve

Chase just dropped the most significant update to its Sapphire Reserve lineup ever, and I have mixed feelings about it… We’re talking new benefits, new booking system, and the highest sign-up bonuses we’ve seen on a Chase card… but also the highest annual fee ever on a Chase personal card: $795.

Let’s break it down.

🚀 The Launch: Two Cards, Two Big Bonuses

Sapphire Reserve (Personal)

🔹 100,000 Chase points

🔹 $500 Chase Travel credit

🔹 After spending $5,000 in 3 monthsBusiness Sapphire Reserve

🔹 200,000 Chase points

🔹 After spending $30,000 in 6 months

These are serious numbers, but there’s more to the story.

My Take: The Good, The Bad, and The Real Value

1. Big Bonus… But Not That Big?

Let’s be honest, I was expecting a bit more from Chase. Ben from @BensBigDeal and I were on an IG Live last week and we guessed the bonus would be around 120K–125K. So yes, 100K + $500 is technically higher value wise… but it feels a little underwhelming when other banks are throwing out 150K+ in points alone. I’d prefer 150,000 Chase points over 100,000 points and $500 in travel credit.

IG LIVE with Ben from @BENSBIGDEAL

The 200K business bonus is huge, but come on, that’s $5,000/month for 6 months. That’s a big stretch for most people in Hawaii.

2. Chase Is Getting Stricter With Sign-Up Rules

This part caught me off guard. Chase added some new fine print that could seriously limit your eligibility:

“This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as well as other factors in determining your bonus eligibility. “

Translation? If you’ve ever had a Sapphire card, or opened/closed a lot of Chase cards, you might get denied the bonus, even if you’re approved. That’s a big shift. Is Chase starting to copy Amex's “pop-up jail”? It’s possible.

3. Points Boost – Better Than Before or a Downgrade?

Chase is officially phasing out the old 1.5x (Sapphire Reserve) and 1.25x (Sapphire Preferred) redemptions through Chase Travel. Going forward, “Points Boost” is the only way to get enhanced value—and only if a Boost is available.

Here’s how it really works:

📅 Timeline

If you opened your Sapphire card before June 23, 2025, you’ll still get:

1.25x (Preferred) or 1.5x (Reserve) value on points earned before Oct 26, 2025

Valid until October 26, 2027

If you open a new card on or after June 23, 2025, you’re on the new system only, Points Boost or 1x.

🔍 What Is Points Boost?

It’s Chase’s new way of offering dynamic value for bookings via Chase Travel. You’ll only get better-than-1x value ifthere’s a Boost available. Here's what the Boost values look like:

✈️ Flights – Sapphire Reserve

| Cabin Class | Boost Value |

|---|---|

| Economy | 1.5x |

| Premium Economy | 1.75x |

| Business / First Class | 2.0x |

🏨 Hotels – Sapphire Reserve

| Hotel Type | Boost Value |

|---|---|

| The Edit Hotels | 2.0x |

| Other Hotels | 1.75x |

🔎 Boost Availability: Hit or Miss

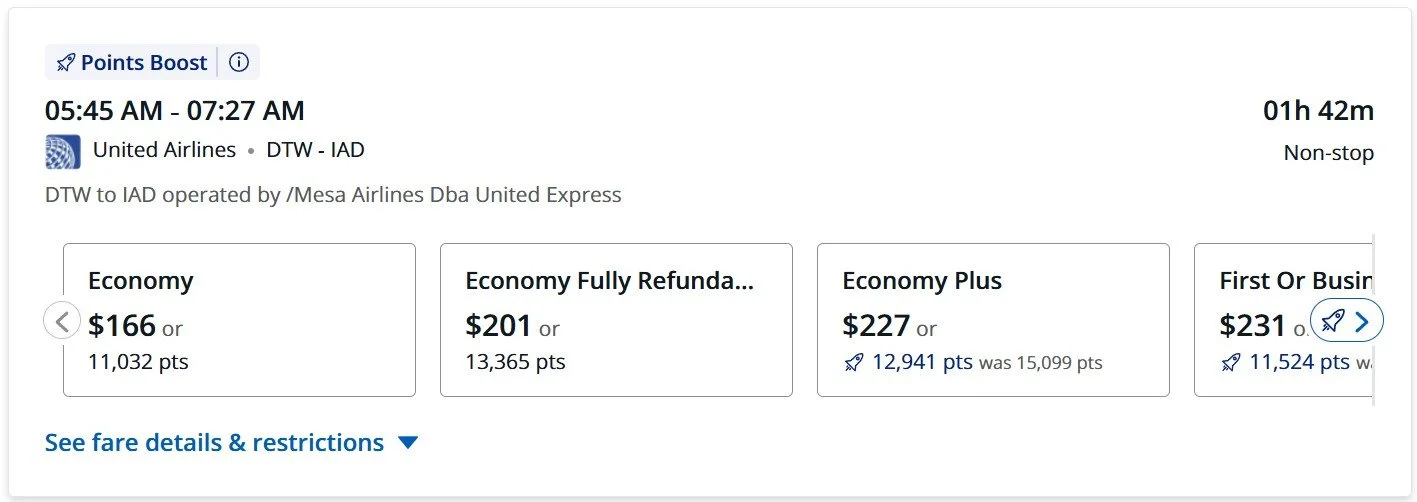

Flights: Boosts are common on United but spotty elsewhere

United: Almost every flight boosted

Emirates, Qantas, Air Canada, Singapore: Some boosted

Southwest: No boosts found so far

Hotels: Boosts vary by city and brand

The Edit hotels always boost to 2x—but only available in major cities

Outside of The Edit, boost options are inconsistent

Points Boost appears on almost every United flight.

🚫 No Boosts for:

Activities

Car rentals

Cruises

If you're not seeing a Points Boost, your points are only worth 1 cent each.

Chase says Points Boosts will be available on select airlines and the value will vary depending on the cabin class you book.

🌺 My Take for Hawaii-Based Travelers

This is an expensive premium card with a lot of perks to manage, but if you're a frequent traveler who loves staying at luxury properties and can use the Chase dining credit at local spots like MW Restaurant, NamiKaze or Senia, this might be the right card for you.

When I told my wife about the dining credits, she said, “That’s two extra date nights this year.” I mean… I can’t complain!

Need Help Picking Your Next Travel Card?

We help Hawaii-based travelers maximize points for luxury trips, island hops, or family vacations.

✅ Free personalized plan

✅ Ongoing flight deal alerts

✅ Local-first travel advice